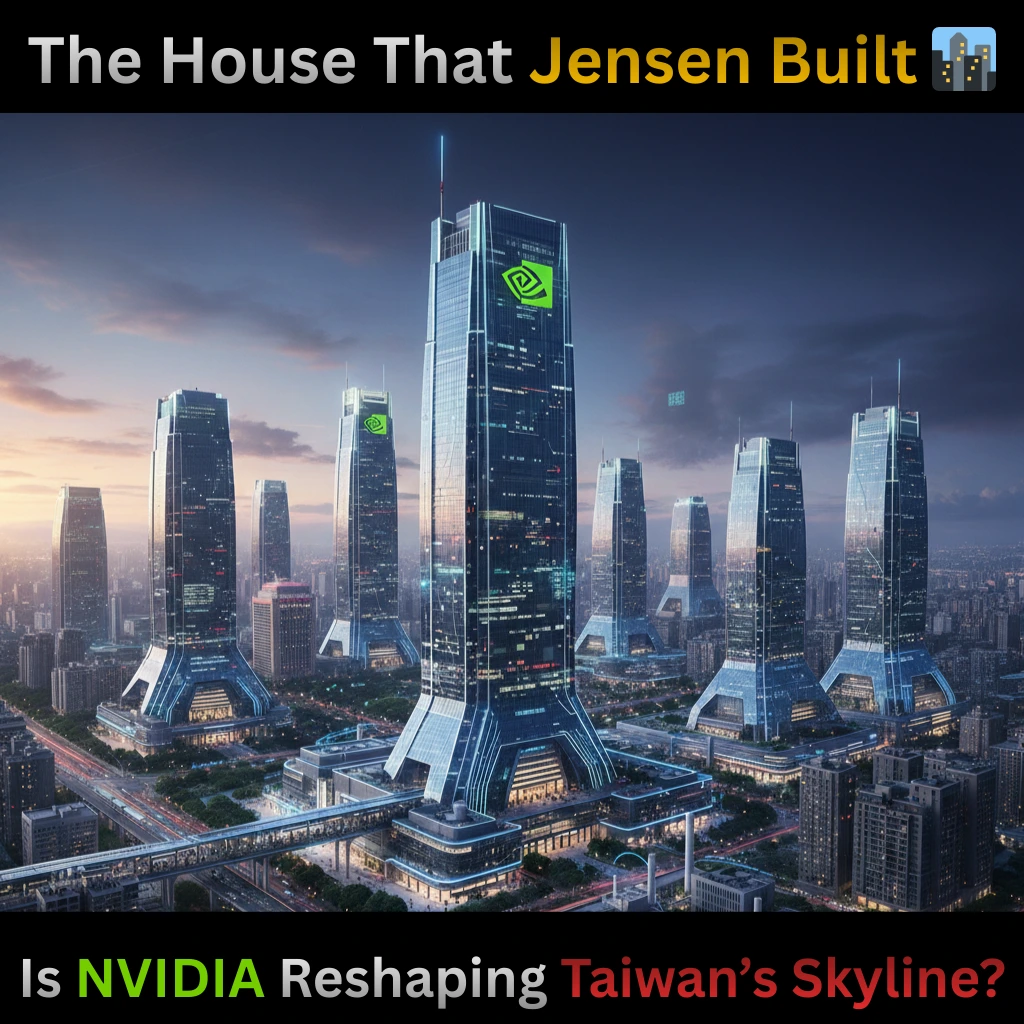

Is it possible for a single company to reshape the skyline of an entire nation? If you walk through the streets of Taipei or the industrial corridors of Kaohsiung right now, the answer is a resounding yes.

While the world watches NVIDIA’s stock tickers, Taiwan is feeling the “Jensen Huang effect” in a much more literal way: through bricks, mortar, and skyrocketing land prices. The island isn’t just the world’s foundry anymore; it’s becoming the physical headquarters of the global AI revolution.

The “Jensen Huang Effect” Hits the Ground

For decades, Taiwan’s economic story was told through the lens of TSMC and the steady hum of semiconductor fabrication. But today, the narrative has shifted. NVIDIA’s aggressive expansion-including the establishment of massive R&D centers and AI supercomputing hubs like “Taipei-1”-has sent a jolt through the local economy.

It’s no longer just about exporting chips. It’s about the massive infrastructure required to design and test them. This influx of high-paying tech roles and corporate investment has triggered a real estate surge that is catching even seasoned investors off guard. When a tech giant moves in, they don’t just bring servers; they bring a demand for luxury housing, modern office spaces, and high-end retail.

Why Real Estate is the New “AI Play”

Why are property prices in Taiwan’s tech corridors hitting record highs? It comes down to the ecosystem. NVIDIA doesn’t operate in a vacuum; its presence acts as a magnet for a “clump” of suppliers and partners.

- Proximity is Power: Engineering teams need to be near the hardware. This has led to a bidding war for commercial plots near Science Parks.

- The Talent Influx: Thousands of high-earning AI engineers are looking for homes, driving up residential demand in previously quiet districts.

- Infrastructure Upgrades: Local governments are fast-tracking transit projects to connect these emerging AI hubs, further boosting land value.

However, this boom isn’t without its critics. As Taiwan’s AI-powered economy soars in shadow of bubble fears and China threats, many locals wonder if the average citizen is being priced out of the “AI dream.” Can a nation’s housing market sustain this level of vertical growth without eventually cooling off?

Solidifying the Island as a Global AI Hardware Hub

Taiwan has successfully transitioned from being a “contract manufacturer” to the indispensable backbone of AI. If you’re building an LLM (Large Language Model) in Silicon Valley, the “brains” of your operation were likely born in a Taiwanese lab.

NVIDIA’s decision to deepen its roots here is a strategic masterstroke. By leveraging Taiwan’s unparalleled supply chain-from cooling systems to advanced packaging-NVIDIA ensures its hardware roadmap remains years ahead of the competition. This synergy has turned the island into a one-stop shop for AI hardware, making it nearly impossible for any other region to replicate this density of expertise.

The Geopolitical Tightrope We can’t talk about Taiwan’s

AI boom without mentioning the elephant in the room. The concentration of the world’s most valuable technology on one island creates a high-stakes geopolitical environment. Yet, interestingly, the “Silicon Shield” seems to be thickening. The more integrated NVIDIA and other AI titans become with Taiwan’s physical landscape, the more the global community has a vested interest in the island’s stability.

Final Thoughts: A New Chapter or a Tech Bubble?

So, where does this leave us? We are witnessing a historic transformation where digital wealth is being converted into physical dominance. Taiwan is no longer just a dot on the map for tech enthusiasts; it is the pumping heart of the AI era.

Will the real estate market eventually plateau? Perhaps. But as long as the world’s appetite for compute remains insatiable, Taiwan’s role as the global AI hardware hub seems safer than ever. The question isn’t whether the boom is real-it’s how much higher the skyline can go.

FAQs

Find answers to common questions below.

What exactly is the "Jensen Huang effect" on Taiwan's economy?

It refers to the massive surge in investor confidence and local spending triggered by NVIDIA’s physical expansion. This isn't just about stocks; it’s about the tangible demand for high-end infrastructure and housing for thousands of new tech specialists.

Is the Taiwan AI real estate boom sustainable or a bubble?

While prices are at record highs, the growth is backed by physical R&D centers and manufacturing plants. However, experts keep a close eye on geopolitical tensions and interest rates to see if the "bubble" might eventually face a correction.

Which regions in Taiwan are seeing the highest property growth?

Traditional hubs like Hsinchu remain hot, but newer interest is flooding into Kaohsiung and specific districts in Taipei where NVIDIA and its partners are establishing "AI supercomputing hubs."

How does this boom affect the average resident in Taiwan?

It’s a double-edged sword. While it brings high-paying jobs and modern infrastructure, it also creates a "pricing out" effect, making it harder for non-tech workers to afford housing in these emerging "Silicon Corridors."